nc sales tax on non food items

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. North Carolina has a 475 statewide sales tax rate.

Sales And Use Tax Rates Effective October 1 2020 Ncdor

Sales and Use Tax Sales and Use Tax.

. Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price. County and local taxes in most areas. While the North Carolina sales tax of 475 applies to most transactions there are certain items that may be exempt from taxation.

Depending on local municipalities the total tax rate can be as high as 75. Maximum Local Sales Tax. Sales Tax Rates In Major Cities Tax Data Tax Foundation.

Average Local State Sales Tax. The information included on this website is to be used only as a guide. Retail sales and use tax.

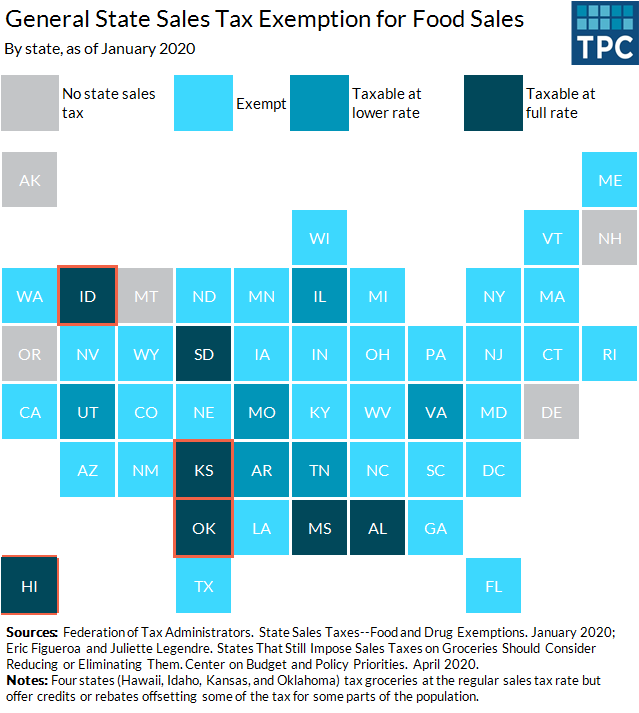

With the exception of some. Arizona grocery items are tax exempt. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7.

Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any. The North Carolina NC state sales tax rate is currently 475. The Article 43 half-cent Transit.

A customer buys a toothbrush a bag of candy and a loaf of bread. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent. Friday June 10 2022.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Laundries Apparel and Linen Rental Businesses and Other Similar Businesses.

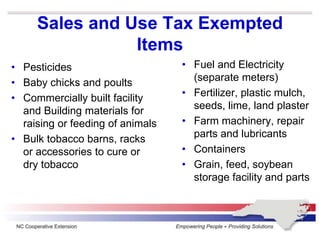

Maximum Possible Sales Tax. Certain items have a 7-percent combined general rate and some items have a miscellaneous. The sale at retail and the use storage or consumption in this State of the following items are specifically exempted from the tax imposed by this Article.

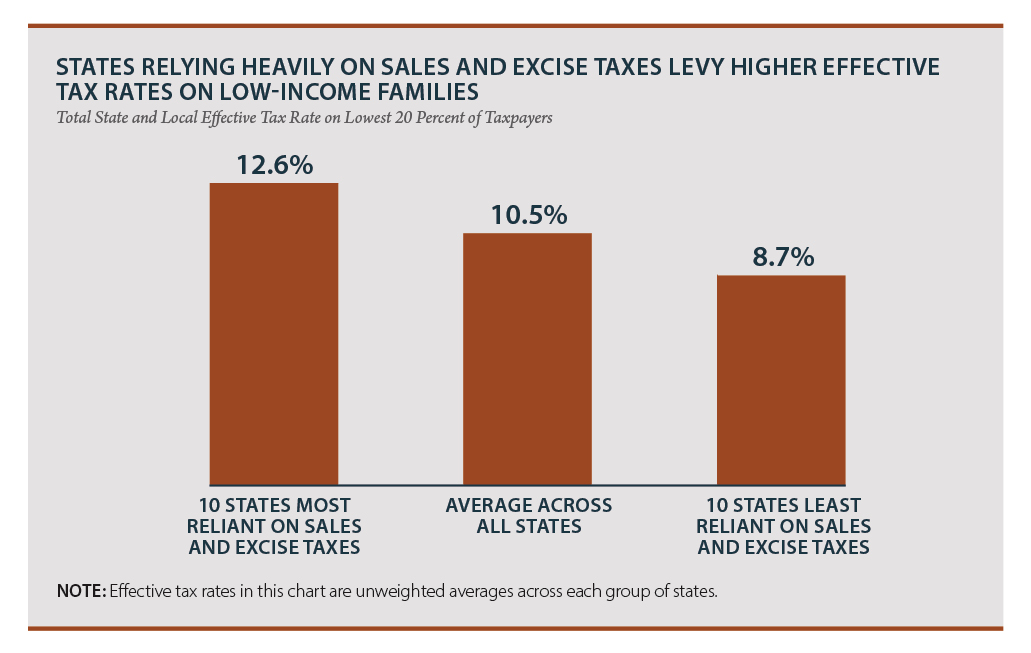

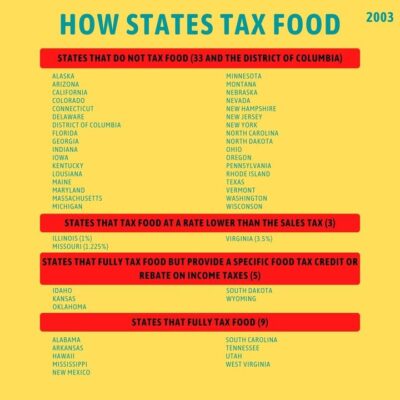

This page discusses various sales tax exemptions in North. The North Carolina state sales tax rate is 475. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food.

It is not intended to cover all provisions of the law or every taxpayers. North Carolinas general state sales tax rate is 475 percent. Some examples of items that exempt from North Carolina sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in research and.

Nc sales tax on non food items. North Carolina State Sales Tax. Is Food Taxable In North Carolina Taxjar.

Prescription Drugs are exempt from the North Carolina sales tax.

Sales Tax Holidays A Boondoggle Itep

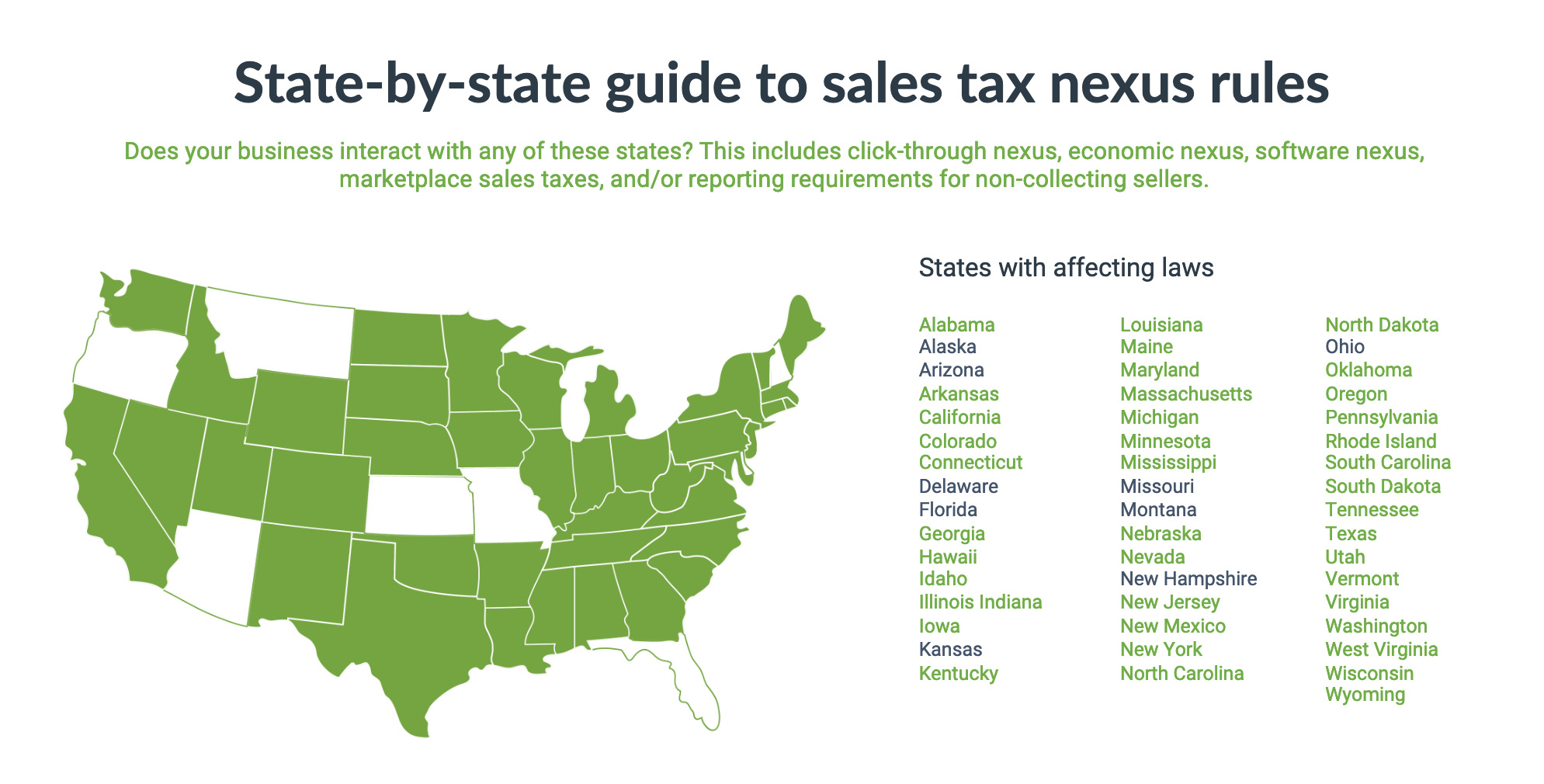

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

North Carolina Sales Tax Update

Sales Tax By State To Go Restaurant Orders Taxjar

At Salvage Stores The Fan Base For Food Deals Grows The New York Times

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Bill That Would Let Some Snap Users Buy Prepared Food Has Bipartisan Support Sdpb

Ohio Sales Tax For Restaurants Sales Tax Helper

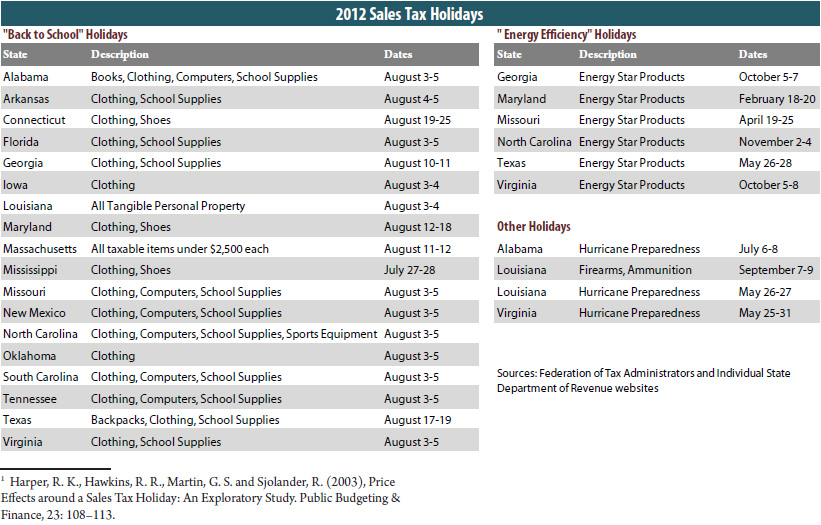

Why Did Nc Get Rid Of Tax Free Weekends Sales Tax Holiday Explained Charlotte Observer

North Carolina Sales Tax Rate Rates Calculator Avalara

Sales Taxes In The United States Wikipedia

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

Is Food Taxable In North Carolina Taxjar

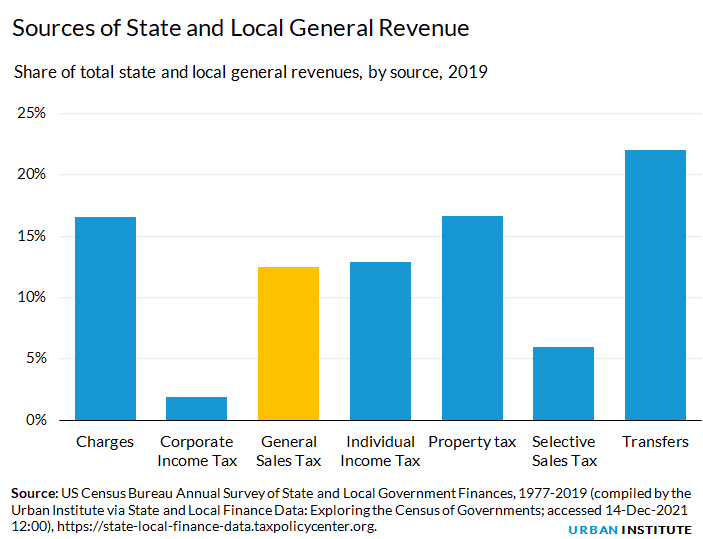

General Sales Taxes And Gross Receipts Taxes Urban Institute

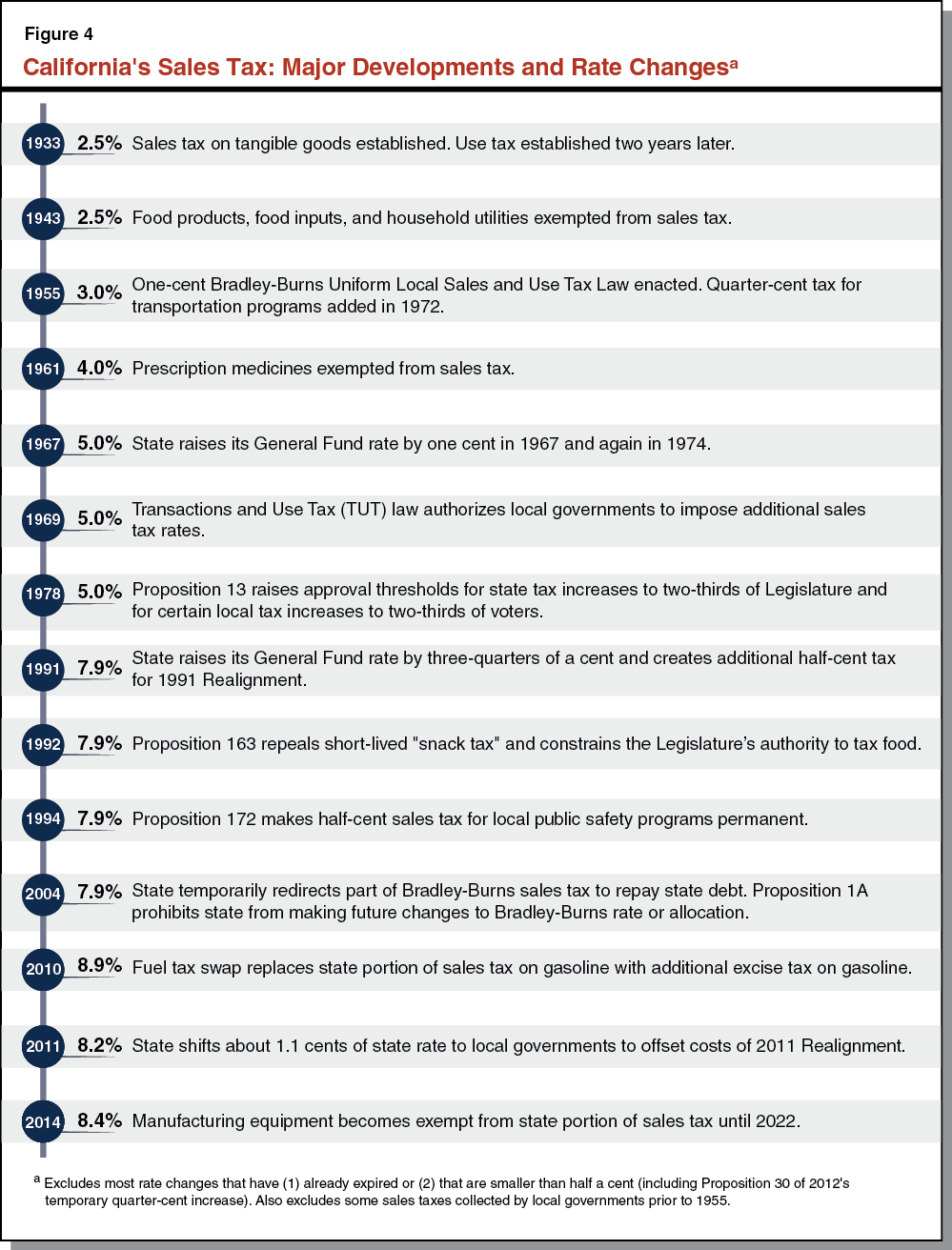

Understanding California S Sales Tax